GST Return Filing & Compliance

Essential for Tax Liability Calculation • Avoid Penalties • Maintain GST Registration

GST Return Filing – Understand Your Tax Responsibilities

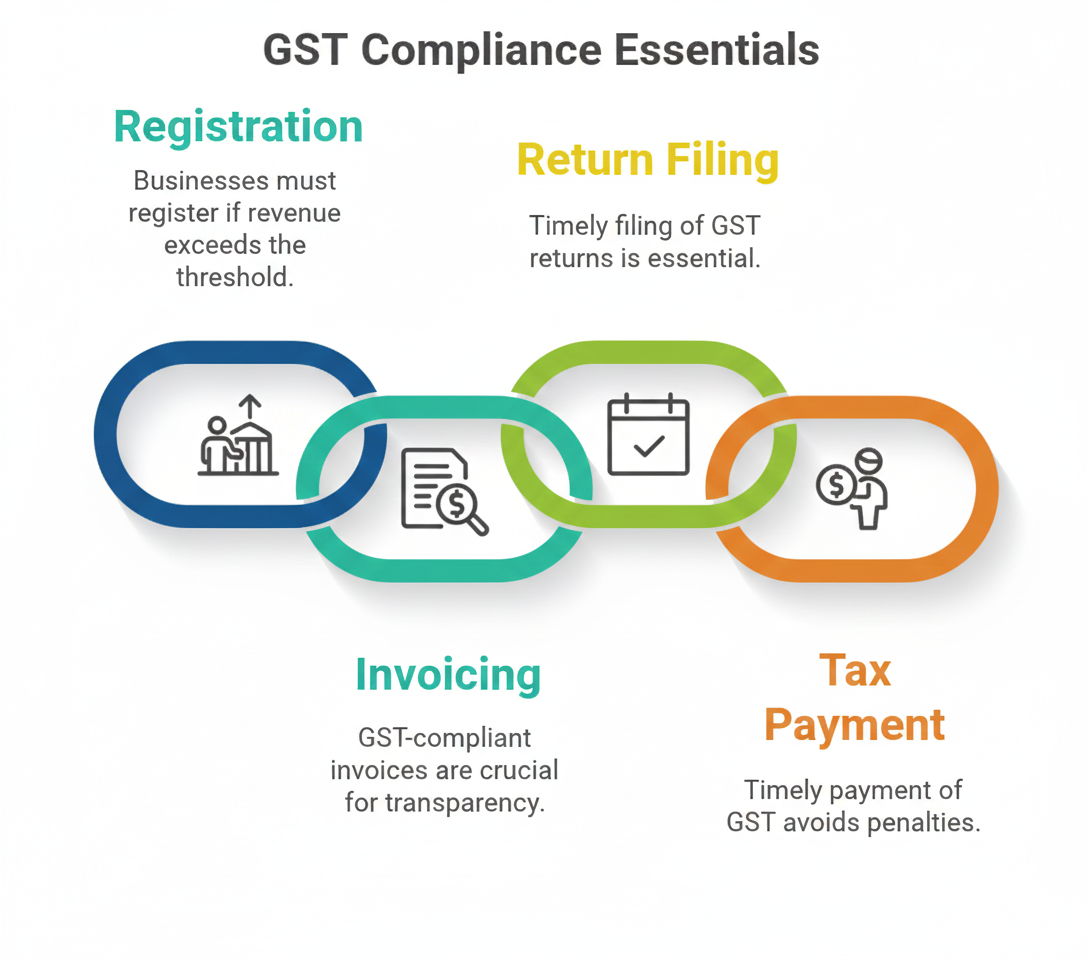

GST return filing is a mandatory compliance process where every registered taxpayer submits details of their business transactions to the tax authorities. These returns help the government determine the accurate tax liability based on the information of sales, purchases, output GST (collected on sales), and input tax credit (GST paid on purchases). To file GST returns correctly, businesses must maintain proper GST-compliant invoices and accurate records of all financial activities.

Mandatory GST Returns (w.e.f 1st Jan 2021)

GSTR-3B

Summary return of inward and outward supplies, to be filed Monthly or Quarterly (depending on turnover scheme).

GSTR-1

Detailed return of Outward Supplies (Sales), to be filed Monthly or Quarterly.

GSTR-9

The Annual Return, consolidating all monthly/quarterly filings for the entire financial year.

Optional Forms: IFF (Invoice Furnishing Facility) and PMT-06 can be filed by quarterly filers, but no penalty is applicable for not filing them.

Different Types of GST Returns & Due Dates

| Type of Return | Description | Due Dates |

|---|---|---|

| GSTR-1 | Export sales/Domestic sales or supply of services | 11th of next month |

| GSTR-2B | Inward return (Details about your purchases made during month) | 14th of next month |

| GSTR-3B | Monthly return (for cumulative records of inward and outward made during month) | 20th of next month |

| GSTR-4 | A return by Composite dealer (a person availing such service with supplies Rs. 1.5 Crore) | 18th of next quarter |

| GSTR-5 | Monthly return by Non resident taxable person | 13th of next month |

| GSTR-6 | Monthly return by input service distributor | 13th of next month |

| GSTR-7 | Person who are required to deduct TDS | 10th of next month |

| GSTR-8 | E-commerce market places who are required to deduct TDS | 18th of next quarter |

| GSTR-9 | Annual Return | 31th december of next financial year. |

| GSTR-9C | Reconcilation | 31th december of next financial year. |

Note: The due dates for GSTR-1 and GSTR-3B can vary based on turnover and State/Quarterly filing scheme.

Documents & Details Required for GST Returns

Credentials & Authentication

- GST ID and Password (Login Credentials).

- Software path (Accounting software data).

- DSC (Digital Signature Certificate) for companies.

- Mobile/Email OTP in other cases (EVC).

Details of Purchase

- Purchase made from Registered person

- Purchase made from Unregistered person

- Goods liable for Reverse charge

- Other RCM

Details of supply

- Outward supply to Registered person

- Outward supply to Unregistered person

- Exempt sale

Penalties for Late Filing of GST Return

| If you Fail to file GST returns on time it can lead to penalties and cancellation of GST registration. If one does not submit a GST return for six months, then the GST registration would be cancelled, and the person would not be able to obtain another GST registration - unless all the late filing penalty is paid. |

| For people having NIL return and for persons having turnover, the penalty for late filing GST return are different. NIL GST return must be filed for an individual with no business . Failure to file NIL GST return can lead to a late fine of Rs.20 per day for each of the GSTR-3B return and GSTR-1 return. So, failure to file NIL GST return can result in a late fine of Rs.40 per day. |

| In case a person has business activity during the period for which GST return is late-filed, then a late fine of Rs.50 per day will be applicable for late GSTR-3B return and Rs.50 per for GSTR-1 return. |

| In addition to the above late filing fees, the person would also have to pay interest at the rate of 18% on GST payment remitted late to the Government. |

Additional Consequences

- Interest: 18% per annum on the GST payment remitted late to the Government.

- Registration Cancellation: Failure to file GST returns for six months can lead to the cancellation of GST registration.

- Restriction: Cannot obtain another GST registration until all late filing penalties and dues are paid.

Simple & Transparent Pricing for Gst Return Filing

Scale your features as your business grows. Find the plan that fits your needs today.

Basic Plan

- 3 months GST return filing for ONE GSTIN

- Book-Keeping and Accounting are not part of this package

- 10 minutes interactive session with clients.

- Cloud backup for 10 years

- Importing data of any softwares

- Filing of GST1 and GSTR-3B for B2B and B2C invoices

- ITC reconciliation

Standard Plan

- 6 months GST return filing for ONE GSTIN

- Unlimited Sales invoices

- Unlimited Purchase Invoices

- ITC reconciliation

- Filing of GST1 and GSTR-3B for B2B and B2C invoices

- Importing data of any softwares

- Cloud backup for 10 years

- 10 minutes interactive session with clients

- Book-Keeping and Accounting are not part of this package

Premium Plan

- 12 month GST return filing for ONE GSTIN

- Unlimited Sales invoices

- Unlimited Purchase Invoices

- ITC reconciliation

- Filing of GST1 and GSTR-3B for B2B and B2C invoices

- Importing data of any softwares

- Cloud backup for 10 years

- 10 minutes interactive session with clients

- Book-Keeping and Accounting are not part of this package

FAQ's on GST Return Filing

Your Questions Answered

What is the most important monthly return for regular GST taxpayers?

The two most important monthly/quarterly returns for regular taxpayers are GSTR-1 (details of outward supplies/sales) and GSTR-3B (a summary statement for liability declaration and tax payment).

What is the due date for filing GSTR-1?

The due date for GSTR-1 is the 11th of the following month for monthly filers, or the 13th of the month following the quarter for taxpayers under the QRMP scheme.

What is the due date for filing GSTR-3B?

The due date for GSTR-3B is the 20th of the following month for monthly filers. For quarterly filers (QRMP), the due date is the 20th or 24th of the month following the quarter, depending on the state.

What is the purpose of the GSTR-2B form?

GSTR-2B is a static, auto-drafted statement of Input Tax Credit (ITC) that is generated on the 13th of every month, based on the GSTR-1 filed by the suppliers. It is crucial for reconciling ITC claims.

What is a "Nil" GST return and when should it be filed?

A "Nil" return (for GSTR-1 or GSTR-3B) is filed when there are no outward supplies (sales), no inward supplies (purchases), and no tax liability for that tax period. It must be filed to maintain compliance.

Can a filed GST return (e.g., GSTR-3B) be revised or amended?

No, once a GSTR-3B is filed, it cannot be revised. Any errors or discrepancies must be corrected by making adjustments in the subsequent month's or quarter's return filings.

What happens if a GST return is filed late?

Late filing attracts a penalty/late fee, which is a daily charge (e.g., Rs 50 per day for GSTR-1/3B) plus interest (18% per annum) on the unpaid tax liability. Chronic non-filing can lead to GST registration cancellation.

What is the QRMP scheme?

The QRMP (Quarterly Return Monthly Payment) scheme is an optional scheme for small taxpayers (turnover up to Rs 5 Crore) that allows them to file GSTR-1 and GSTR-3B quarterly while still paying tax monthly through a simple payment form (PMT-06).

GST Return Filing

Timely filing of GST returns to ensure full compliance and avoid penalties.