Section 8 Company Registration – For Non-Profit Objectives

Promote Arts, Science, Charity & Welfare • Separate Legal Entity • Zero Minimum Capital

Objective: Non-Profit Mission

The primary purpose is to promote fields like arts, science, research, education, sports, charity, or social welfare, with profits applied solely to these goals.

Minimal Statutory Requirements

Requires a minimum of two directors and has no mandatory requirement for minimum paid-up capital.

What is a Section 8 Company?

The Companies Act defines a Section 8 company as one whose objectives is to promote fields of arts, commerce, science, research, education, sports, charity, social welfare, religion, environment protection, or other similar objectives.

The primary purpose of registering a company as a Section 8 Company is to promote non-profit objectives such as trade, commerce, arts, charity, education, religion, environment protection, social welfare, sports research, etc.

To incorporate a Section 8 Company, a minimum of two directors are required. Also, there is no requirement of minimum paid-up capital in the case of Section 8 Company.

In India, a non-profit organization can be registered under the Registrar of societies or as a Non-profit company under the Section 8 Company of the Company Act,2013.

The profits of this company, if there are any, are applied towards promoting the objectives of the company and not distributed as dividends to its shareholders.

Benefits of Registration

- A separate legal identity. Section 8 Company is a distinct legal entity from its members.

- No stamp duty on registration.

- No Minimum Capital requirement.

- Significant Tax Benefits for the company and Exemption to Donors under Section 80G of the Income Tax Act.

- Enhanced Credibility and public trust compared to non-registered entities.

- Need for CARO (Companies Auditor's Report Order) exemption.

Documents Required

- Digital Signature Certificate (DSC - Class 3)

- Passport Size Photographs of all Members/Directors

- Members’ ID Proof: Aadhaar Card, Passport, Voter ID, or Driving License.

- Bank Pass Book of members first page with name and address.

- Address Evidence: Utility bills (Electricity, Gas, etc.) for the Registered Office.

- Details of Directors (When the Members Are Other Companies/LLPs).

Annual Compliances for Section 8 Company

- Appointment of an auditor.

- Maintenance of Statutory Registers.

- Calling board meet.

- Statutory Audit.

- GM notice (General Meeting Notice issuance).

- Calling AGM (Annual General Meeting).

- Board Reports (Preparation of Directors' Report).

- Making of Financials Statement of the Company.

- Tax returns (Filing of Income Tax Return).

- Tax audit (If applicable, based on turnover limits).

- Filing Financial Statements.

- Annual Return Filing.

- DIN KYC (Annual filing of DIR-3 KYC for directors).

Simple & Transparent Pricing for Section 8 Company

Scale your features as your business grows. Find the plan that fits your needs today.

Basic Plan

Prices are inclusive of GST

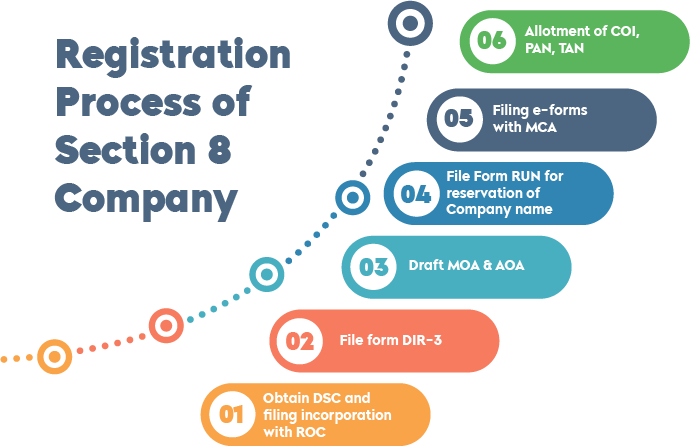

- Class 3 digital signature certificate - 2 pcs

- Director identification numbers - 2 number

- RUN name approval

- Incorporation fee

- Incorporation certificate

- MOA

- AOA

- Certificate of commencement

- PAN & TAN

- Share certificates (e-copy)

- Free consultancy by expert CA for 1 month only in relation to legal compliance of Registered company

Standard Plan

Every month payment option Available. Prices are inclusive of GST

- Class 3 digital signature certificate - 2 pcs

- Director identification numbers - 2 number

- RUN name approval

- Incorporation fee

- Incorporation certificate

- MOA

- AOA

- Certificate of commencement

- PAN & TAN

- Share certificates (e-copy)

- Appointment of an auditor

- Maintenance of Statutory Registers

- Calling board meet

- Statutory Audit

- GM notice

- Calling AGM

- Board Reports

- Making of Financials Statement of the Company

- Tax returns

- Tax audit

- Filing Financial Statements

- Annual Return Filing

- DIN KYC

- Free consultancy by expert CA for 1 month only in relation to legal compliance of Registered company

Premium Plan

Every month payment option Available. Prices are inclusive of GST

- Class 3 digital signature certificate - 2 pcs

- Director identification numbers - 2 number

- RUN name approval

- Incorporation fee

- Incorporation certificate

- MOA

- AOA

- Certificate of commencement

- PAN & TAN

- Share certificates (e-copy)

- Appointment of an auditor

- Maintenance of Statutory Registers

- Calling board meet

- Statutory Audit

- GM notice

- Calling AGM

- Board Reports

- Making of Financials Statement of the Company

- Tax returns

- Tax audit

- Filing Financial Statements

- Annual Return Filing

- DIN KYC

- 12AB/80G Certificate

- Ngo Darpan

- Free consultancy by expert CA for 1 month only in relation to legal compliance of Registered company

FAQ's on Section 8 Company

Your Questions Answered

What is the primary objective of a Section 8 Company?

The primary objective is the promotion of commerce, art, science, sports, education, research, social welfare, religion, charity, or the protection of the environment.

Can a Section 8 Company use its profits for paying dividends to members?

No, a Section 8 Company must apply all its profits, if any, or other income towards promoting its objects and cannot pay any dividend to its members.

Is there any minimum capital requirement to incorporate a Section 8 Company?

No, there is no minimum paid-up capital requirement to incorporate a Section 8 Company.

What is the minimum number of members/directors required for a Section 8 Company?

A Section 8 Company requires a minimum of two directors and two members (unless incorporated as a One Person Company, which is generally not the case for NPOs).

Can a Section 8 Company be converted to any other type of company?

Yes, a Section 8 Company can be converted to any other kind of company by following the prescribed rules and obtaining approval from the Central Government.

Does a Section 8 Company have to comply with the rules of the Companies Act, 2013?

Yes, although it is an NPO, it is registered under the Companies Act, 2013, and must comply with all applicable provisions, including annual filings.

Is a Directors Identification Number (DIN) mandatory for the directors of a Section 8 Company?

Yes, similar to other companies, all directors must possess a valid Directors Identification Number (DIN).

Is a Section 8 Company similar to a non-profit Trust or Society?

While all three are non-profit structures, a Section 8 Company is governed by the Ministry of Corporate Affairs (MCA) under the Companies Act, making it more regulated and offering higher credibility.

What is the Director Identification Number?

Director Identification Number is a unique identification number assigned to all existing and proposed Directors of a Company. It is mandatory for all present or proposed Directors to have a Director Identification Number. Director Identification Number never expires and a person can have only one Director Identification Number.

What is difference between NGO and Section 8 company?

A Non-Governmental Organization (NGO) is an organization that is independently established and operated, usually with a charitable, educational, religious, or social purpose. NGOs are usually non-profit and do not have a profit motive.

A Section 8 Company is a non-profit organization formed to promote commerce, art, science, sports, education, research, social welfare, religion, charity, protection of environment or any other such object. Section 8 companies are allowed to generate profit but they must use their profits for the purpose of achieving their goals and not for the benefit of its members.

Non-Profit Company Formation

Section 8 Company registration is designed for organizations focused on social, charitable, or educational objectives. It offers a legally recognized structure with strong compliance and long-term credibility under the Companies Act, 2013.

Section 8 Company Registration

A Section 8 Company is a non-profit entity registered under the Companies Act, 2013, formed to promote charitable, social, or educational objectives. All profits are reinvested to support its mission, ensuring transparency and legal credibility.